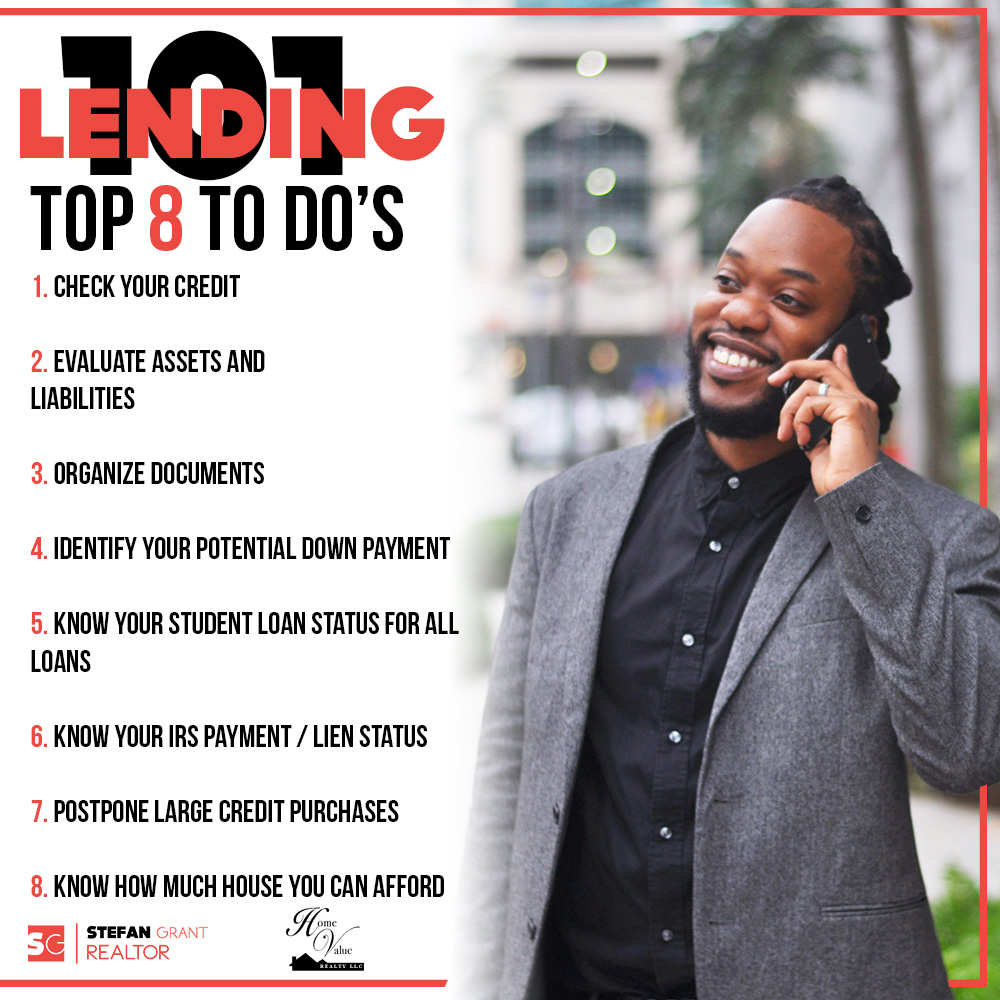

On the path to purchasing your first or next home, preparing for loan approval is an important part of the process. To make the process a little smoother for you, I’ve created this post to shine some light on some of the key steps in that process and get you closer to living in your dream home.

On the path to purchasing your first or next home, preparing for loan approval is an important part of the process. To make the process a little smoother for you, I’ve created this post to shine some light on some of the key steps in that process and get you closer to living in your dream home.

Step 1: Check Your Credit.

As you probably know by now, credit is a major component to factor in when considering a loan as an option for purchasing your home. One of the things banks like to see is a solid credit history and a positive credit score. Contrary to popular belief, checking your credit doesn’t affect your score and you can do it for free. I personally like using CreditKarma.com.

Step 2: Evaluate Your Assets and Liabilities

This is not just a major step in qualifying for a loan, it’s also a key step in your regular personal financial management. Because a financial institution is going to loan you hundreds of thousands of dollars, they need a little assurance that you’ll still be able to keep up payments, at least for a time, in case you happen face financial hardship while in your home. Assets are things you own that can be converted to liquid cash in case such circumstances arise. Your liabilities fall under the category of things you have to pay for such as regular bills; car payments, cell phone bills, Netflix, etc. Banks assess your current obligations and compare them with your income and assets to determine how much new debt you can handle, if any.

Step 3: Organize Documents

You’ll need to have all your important paperwork in order such as your proof of employment, income statements, 2 years of tax returns, W2s for 2 years, and a variety of other documents will need to be on-hand before applying for your loan.

Step 4: Identify Your Potential Down Payment

This step is partially predicated on your credit score. That often determines the amount the lender will require you to put down. This is also contingent on whether or not you’re utilizing programs such as an FHA loan or a VA loan if you’re a member of the U.S. armed service.

Step 5: Know Your Student Loan Status For All Loans

Knowing your student loan status is part of evaluating your debts and liabilities. This is something banks will definitely want to look into so they can determine your ability and likelihood of paying down your mortgage.

Step 6: Know Your IRS Payment / Lien Status

Being up to date with the IRS is mandatory, whether you’re in the market for a new home or not. To find your status and familiarize yourself more with this step, click here: How Much House Can You Afford?

Step 7: Postpone Large Credit Purchases

Do not make any other large, unnecessary purchases before applying for your home loan. Its dope that you just got a raise and want to celebrate, but don’t buy that new Bimmer until you’ve closed on your new home with that beautiful garage for you to park it in.

Step 8: Know How Much House You Can Afford

To determine this you’ll need to do the accounting of all your monthly expenses, the savings you have available for down payment, and various other factors. The rule of thumb is that your monthly expenses shouldn’t exceed 36% of your monthly income.

I hope this helped provide some clarity on your journey toward home ownership.